MIGA (Make India Great Again) (3/3)

Published: 10th April 2025

Category: Current Affairs

If you don't know where you are going, any road will get you there.

—Lewis Caroll

The Union Minister of Commerce recently took a swing at India’s startup ecosystem, which has been

focusing on ideas like food delivery services, astrology apps, consumer artisanal brands, and betting

platforms as against China's progress on Deep Tech, AI, critical minerals, and energy

innovation—implicitly framing India’s entrepreneurial efforts as trivial.

The reaction was mixed. Some founders defended consumer-focused startups for generating jobs and market

dynamism, while others pointed to persistent regulatory hurdles. A few endorsed the minister’s remarks

as a needed reality check.

To me it felt like deflection.

Under mounting pressure since early 2025, the government has been forced to confront its limited global

leverage—exposed by the US-China tariff war and emerging tech race. India's lag in strategic sectors has

become glaring.

On the home front, consumption is slowing down, AI is complicating job creation, inflation is rampant,

and the stock market is extremely volatile spooking both institutional and retail investors. These

challenges aren’t easily pinned on past governments. And as the current regime completes a decade in

power, shifting the blame to the industry appears to be the most convenient escape.

Why are we lagging behind China?

At the heart of the gap between India and China lies a fundamental difference: shared vision.

China’s gravity-defying rise is the product of over forty years of deliberate, state-led

planning. Growth is centrally orchestrated, with GDP treated not as a forecast but as a target, and

policy, capital, and industry efforts aligned accordingly. Public and private sectors operate in

lockstep, with the government actively removing barriers for businesses that contribute to national

goals.

Chinese companies are encouraged to dominate their sectors, with no distinction between domestic and

global markets. Cost and quality benchmarks are set uniformly high, whether for local consumption or

exports. The state has injected trillions in capital through priority lending and targeted initiatives,

ensuring that businesses scale rapidly and decisively.

To bridge knowledge gaps, China has systematically imported talent and technology, often by forcing open

standards and recruiting top global professionals. While some of these tactics may appear and are

aggressive and manipulative, they have enabled China to build unparalleled industrial and technological

strength.

The India brand today is that of "a land of culture and curry". Growth, where it has occurred, has often

been accidental rather than strategic — exemplified by the rise of the software industry, driven more by

linguistic advantage and global demand than deliberate policy.

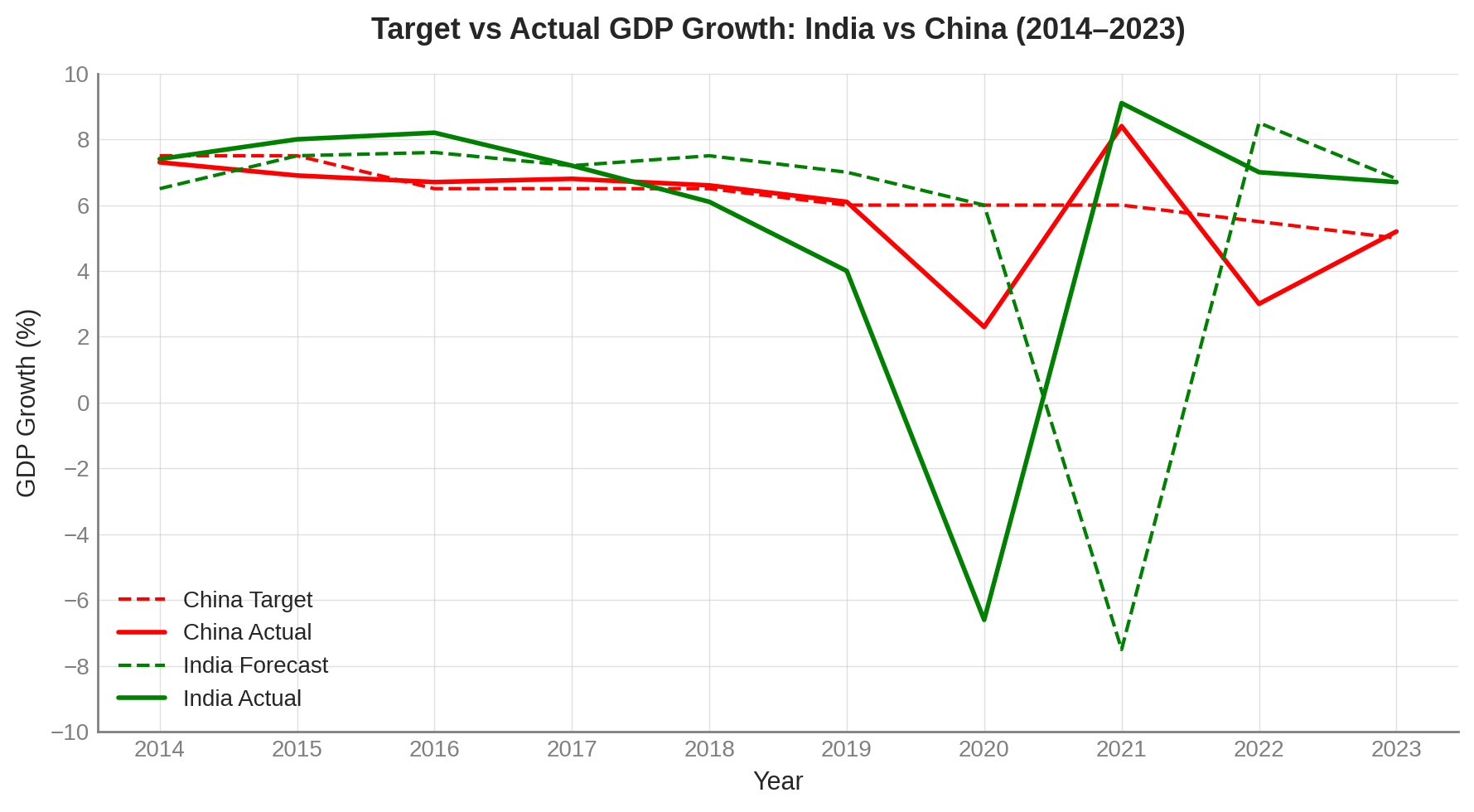

The above graph clearly illustrates China’s disciplined approach to GDP targeting, with minimal deviation between forecasts and actuals. In contrast, India exhibits significantly higher volatility, reflecting a less predictable economic trajectory. The difference is stark especially during COVID period.

The Indian government plays the role of a regulator, restricting its participation to sectors deemed critical for national security like defense, transportation, and telecommunications. Long-term planning is often deferred, diluted, or lost amidst populism and reactive policymaking. A significant share of centrally allocated funds is diverted through patron networks, eventually fueling the next electoral cycle. Lack of vision, insane levels of corruption, fragmented execution, obsolete technology, substandard materials, and chronic cost and time overruns continue to plague critical infrastructure projects. Below table gives details of some of the infrastructure projects of Mumbai (largely regarded as the financial capital of the country).

Infrastructure Debacles: Projects That Never End

| Project | Proposed | Completed | Delay |

|---|---|---|---|

| Worli Sea Link | 1964 | 2009 | 45 years |

| Mumbai Metro | 1990 | Line 1 - 2014, Others WIP | NA |

| Trans Habour Link Road | 1963 | 2024 | 61 years |

| Navi Mumbai Airport | 1997 | est. 2025 | 28 years |

| Eastern Freeway | 1970 | 2013 | 43 years |

| Santacruz Chembur Linkway | 1963 | 2014 | 51 years |

| Bandra Kurla Complex | 1948 | 2010 | 62 years |

Cost overruns average 200–300% for mega-projects (NITI Aayog, 2025).

Industries and financial institutions have also joined in the repeated exploitation of public funds.

undermining efforts aimed at broad-based economic empowerment.

During the COVID-19 pandemic, the Government of India launched collateral-free funding schemes intended

to support small businesses and first-generation entrepreneurs. Yet, in practice, leading banks diverted

these funds towards existing clients, sidestepping the spirit of the initiative. Rather than extending

loans to new enterprises, banks relaxed collateral margins for current borrowers — for instance,

allowing a borrower’s collateral coverage to fall from 90% to 75% — thereby technically meeting the

"collateral-free" requirement without expanding the borrower base.

A more sophisticated manipulation involved creating new companies for existing clients. An engineering

firm, for example, would set up a new entity in a family member’s name, "outsource" part of its

operations to this shell company, and obtain fresh loans in the new entity's name — once again complying

with the scheme’s technical requirements while evading its actual intended purpose.

There is a stubborn national-level unwillingness in us to recognize and correct systemic

failures.

A glaring example was the "Har Ghar Tiranga" campaign, launched in 2021 and revived in 2024.

Despite widespread enthusiasm, it faltered early because domestic industry could not produce sufficient

quantities of the national flag. Instead of addressing this manufacturing gap, the government amended

The Flag Code of India in December 2021 to allow machine-made polyester flags and lifted the 2019 ban on

imports. For the 2024 campaign, flags were imported from China!. For all the talk on "Make in India" we

can't even make our own flags.

There is a deeper malaise here.

The much-touted "Make in India" initiative has devolved into a facade. Companies celebrated as

champions of Indian manufacturing (from automotive to machine tools to consumer goods) often import

major components — or even entire products — assemble or label them locally, and present them as

domestically made. The manufacturing sector's contribution to GDP has stagnated at 15.9% in 2023–24,

falling short of the targeted 25% .

Employment in the manufacturing sector has shown little growth, with the workforce decreasing

from 51.3 million in 2017 to 35.7 million in 2023. The Production Linked Incentive scheme, introduced to

boost manufacturing, attracted investments but faced challenges such as delays in subsidy payouts and

unmet production targets. By October 2024, only $1.73 billion of the allocated funds were disbursed, and

companies produced just 37% of the goods initially targeted.

Despite official rhetoric, India is unlikely to replace China as a global business hub.

Population growth has made us relevant—but not dominant—on the world stage. The over hyped "demographic

dividend" is a mirage, as we stay reliant on external factors like service exports and remittances from

a "brain drain". Our dynamic with China in the foreseeable future will continue to echo that of a

snoring tiger besides a raging dragon.

You cannot escape the responsibility of tomorrow by evading it today.

----Abraham Lincoln