MIGA (Make India Great Again) (2/3)

Published: 28th March 2025

Category: Current Affairs

Poor fellow, he suffers from files.

--Aneurin Bevan

In 1998, during my internship at a Chartered Accountants firm, I was assigned to the internal audit of a

major packaging company. Life was routine initially, but took an unexpected turn, when the client

pursued a proposal for merger, with a European firm.

What began as a promising endeavor, soon became a nightmare in accounting and paperwork for everyone in

our firm. The European firm followed a calendar year (January–December), while the Indian firm adhered

to the April–March financial year. The proposal involved exhaustive recasting of five years of financial

statements, inventory details and other holdings.

The work was grueling: manually extracting data from mainframes and ERP, tabulating reports, and passing

adjustment entries.After four months, with investors satisfied and our fees hiked by 12%, the European

firm took over. Just as we celebrated completion of the audit of the new merged entity, a Japanese firm

acquired the European parent globally and demanded another recast of the packaging firm to align with

their fiscal year. Indian While my boss saw this as another opportunity to mint money, my colleague

Kannan and I were disgusted. A frustrated Kannan complained that “Our entire audit experience is just

recasting financial statements! Why can’t these companies follow the same policies and standards?”

25 years later, the concerns echoed by Kannan continues to plague analysts / accounts departments

across Indian Companies.

POV:-A foreign firm wanting to evaluate an Indian entity for investment or benchmark its performance

against other entities in the same industry but different regions, has to jump through following hoops.

- Recast financial statements to match their period

- Convert all values to home currency / USD. Gauge the impact of currency fluctuations (generally against the USD).

- Convert unit of measurement (lakhs/ crores) to millions / billions.

- Correct the impact of Indian Accounting Standards vs Global norms.

- Rework all amortizations/ depreciations as per home standards.

Note: This is just for primary evaluation and not due diligence.

Any analyst worth his salt knows that by the time they come up with a decent comparison, especially for a target firm with operations across multiple geographies, it would take 5 analysts 10 days to convert their findings into a single page report and by then, the world would have changed or investors’ interest would have moved onto something else.

It's well known in the business circles that each business has a minimum of three financial statements

- An MIS statement used by the management which is forward looking and helps the steer the business course

- A financial statement which is mandatory for compliance for Companies Act

- A set of financial statements / reports which is required for tax authorities (One for direct taxes and another for Indirect taxes.)

- A set of records which changes the financial year for global consolidation

- Removal of Accounting Standards applicable only to India and compliance with global standards again to facilitate consolidation.

Compliance costs in India are among the highest in the world.

Global Comparison of costs and standards (2024–2025)

| Country | Compliance Costs p.a $ | Remarks. |

|---|---|---|

| Singapore | 10,000 - 20,000 | IFRS Compatible, Minimum Disclosures |

| UAE | 8,000-15,000 | No/Low Simplified system |

| UK | 20,000-35,000 | Full Robust legal clarity |

| India | 36,000-72,000 | Dual Accounting, Heavy Compliance burden |

*Dual accounting refers to set of accounts conforming to indian and global norms and multiple periods along with consolidation requirements.

Let’s take the simplest issue among the above. Aligning the fiscal year to Calendar year and see how it

has been dealt with.

The origin of India's financial year running from April 1 to March 31 dates back to the British colonial

era and is primarily linked to administrative convenience and legacy practices inherited from the

British government.

UK followed a financial year from April to March and since the rabi crop (harvested in March) marked the

end of the agricultural cycle they continued the same here. Starting the financial year in April aligned

well with the post-harvest season, allowing the government to assess income and collect revenue. India

was primarily an agrarian economy.

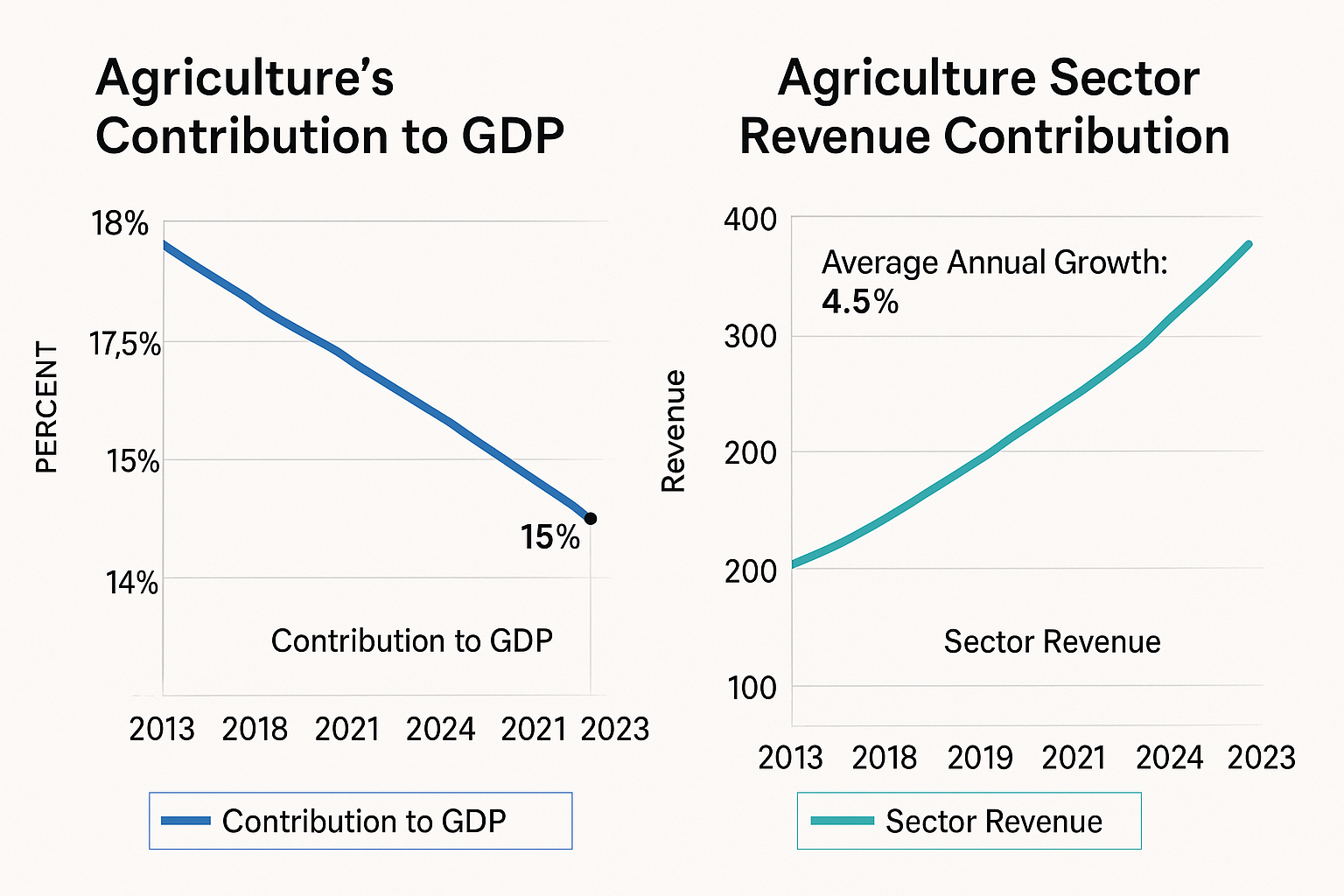

Fast forward to Amrit Kaal, agriculture's contribution to GDP is less 20%.

In 2016, the NITI Aayog put forth a proposal for change in the financial year from April - March to January - December. It was evaluated by Shankar Acharya Committee. Despite potential benefits, the committee highlighted several challenges in changing the financial year, leading to proposal being shelved. Reasons cited were:

Administrative Disruption:

A change would require amendments to a wide range of laws, including:

- Income Tax Act, 1961

- Companies Act, 2013

- Various fiscal and economic regulations

Shifting the financial year would disrupt the established budget presentation time-line, impacting resource allocation and fiscal management.

By year 2020, approximately 140 countries with 88% of India’s trade distribution followed the calendar year as compared to only 12 % which followed April-March cycle.

But somehow the committee felt that estimating the revenue of a diminishing sector for budgeting and administrative convenience was more important than economic analysis and planning or improving Foreign Direct Investment in the country.

In the past 75 years, countries like Ireland, Indonesia and even Sri-Lanka shifted from April-March financial year to calendar year cycle of January-December. It is interesting that Indonesia and Ireland are forcing companies to align international standards while we still can’t. We need the money more than Irish do!

I do not for even a moment believe that we lack the ability to overcome a one-time “administrative disruption” which may be caused by such alignment; after all, this is the same government which, overnight declared 86% of the country’s currency in circulation as illegal tender in 2016.

(Note: No bureaucrats were harmed in the process of Demonetization.)

Part 3 of this article examines loop holes in government policy and implementation along with how citizens deal with it and the resulting impact on the country vs how China fueled its growth for global dominance ably supported by its government.